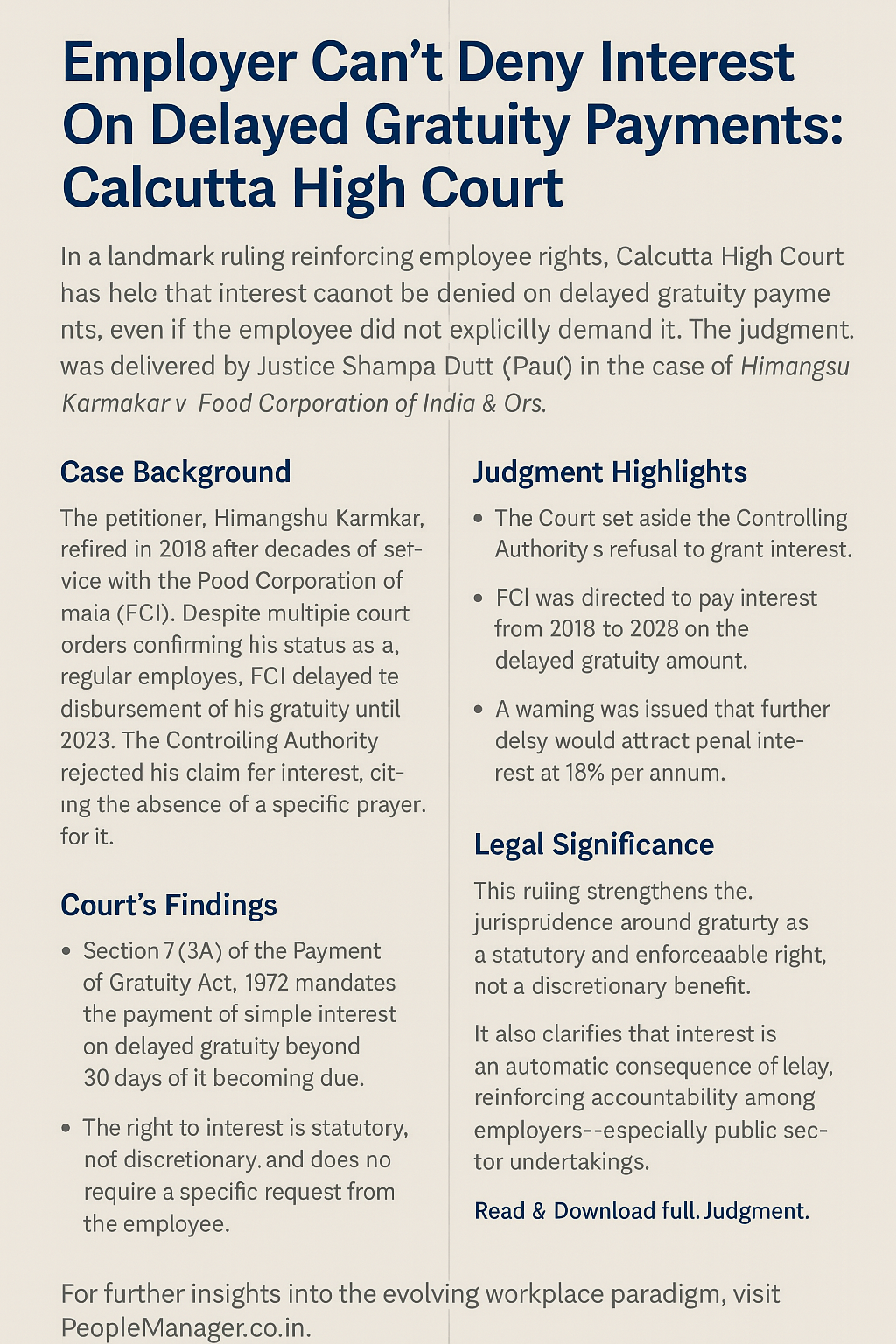

Key compliance from the Calcutta High Court ruling in Himangshu Karmakar v. Food Corporation of India & Ors. (2025)

Background

- Case: Himangshu Karmakar v. FCI & Ors.

- Court: Calcutta High Court

- Decision Date: June 23, 2025

- Citation: 2025 CHC-AS 1093

Key Ruling: Interest on delayed gratuity is statutory and automatic under Section 7(3A) of the Payment of Gratuity Act, 1972. No express demand by the employee is required.

Legal Principles to be Consider

| Principle | Explanation |

|---|---|

| Statutory Right to Interest | Delay beyond 30 days mandates simple interest—automatically due. |

| No Need for Specific Prayer | Employee need not request interest separately for entitlement to arise. |

| Employer Accountability | Administrative or internal delays are not valid grounds for withholding interest. |

| Penalty Warning | Further delay may attract 18% penal interest. |

Compliance Checklist for Employers (HR + Legal Teams)

| Action Item | Status ☐ |

|---|---|

| 🔲 Ensure gratuity payments are made within 30 days of employee exit | |

| 🔲 Implement a standard operating procedure for gratuity computation | |

| 🔲 Configure payroll systems to auto-calculate interest after 30-day delay | |

| 🔲 Document all correspondences and approvals during gratuity processing | |

| 🔲 Train HR and finance teams on statutory obligations under Gratuity Act | |

| 🔲 Avoid interpreting silence as waiver: interest is automatic, not optional | |

| 🔲 Prepare for legal scrutiny: interest denial can lead to litigation | |

| 🔲 Consider internal audit checks for past delayed gratuity settlements |

Good Practice Tip

Include an “Interest Clause” in your full and final settlement SOPs to ensure transparency and avoid legal pushback.

B-20, West Patel Nagar, New Delhi-18 (India) | 011-39330001 |

B-20, West Patel Nagar, New Delhi-18 (India) | 011-39330001 |  +91-762-691-24-36 | Email: info@peoplemanager.co.in

+91-762-691-24-36 | Email: info@peoplemanager.co.in